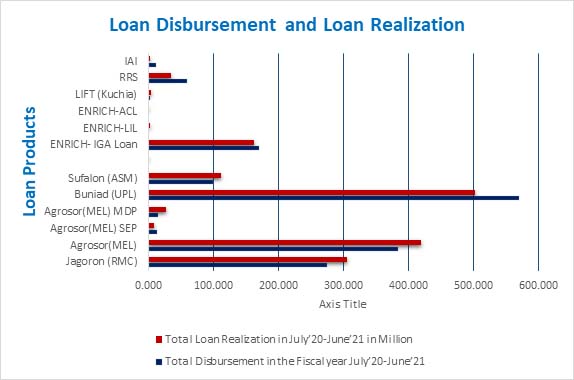

Micro-Enterprise-Agrosor Program

Micro Enterprise (ME) program, now renamed as Agrosor focuses on graduated borrowers who have taken more than two (2) loans from NGF Jagoron Program and have developed successful enterprise are eligible for Agrosor loans. Microenterprise is very essential to reduce poverty in view of the fact that it is the key to income generation & employment creation. These entrepreneurs are playing a vital role in developing in rural and national economy. According to the present Agrosor Loan policy, its loan size ranges from BDT 50,000 to BDT 10,00,000 as per the needs of the entrepreneurs. Apart from the graduated borrowers of Jagoron program, potential individual entrepreneurs also take loans for the enterprise. NGF provides need based capacity/skill development training to the entrepreneurs to help them manage their particular enterprise more competently.